Introducing a Powerful Tool for Financial Planning: Goals in Cashflow

Financial planning just got a whole lot easier with the introduction of the new Goals in Cashflow, a feature that promises to revolutionise the way financial advisers assess and analyse their clients’ financial objectives. This innovative tool provides a detailed look at cashflow and retirement goals and offers various solutions to help clients achieve their financial aspirations.

Unveiling the Goals in Cashflow

Goals in Cashflow is designed to simplify the complex world of financial planning. Here’s a closer look at what this powerful analysis has to offer:

1. Assess Cashflow Goals

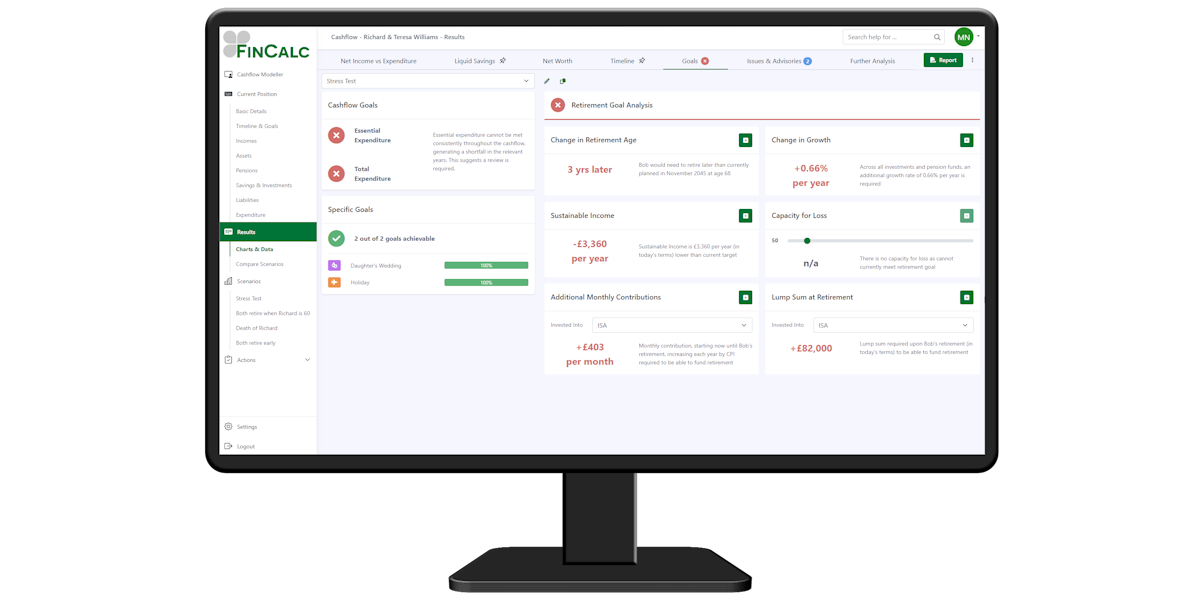

By using Goals, you can instantly determine whether your clients’ Cashflow Goals are achievable. It provides a clear visual representation of whether clients can meet their financial objectives. The software takes into account the financial data and specific goals you’ve set in the cashflow modeller to provide valuable insights.

2. Review Retirement Goal Analysis

One of the standout features of Goals is its in-depth analysis of retirement goals. This section not only confirms the feasibility of retirement goals but also offers six alternative solutions:

Change in Retirement Age: This solution allows you to adjust the retirement age based on goal-seeking analysis. It considers the impact on other events linked to retirement, providing a comprehensive view of retirement planning.

Change in Growth: For those seeking to understand investment growth rates, this feature calculates the required growth rate for risk-related investments and pension funds.

Sustainable Income: This solution helps determine changes in expenditure to make it sustainable during retirement. It offers insights into how clients can either spend more or reduce their expenses.

Capacity for Loss: This option is particularly valuable for those who want to stress-test their investments. It calculates the maximum allowable drop in investment value for retirement to remain achievable.

Additional Monthly Contributions: If retirement appears unattainable, this feature provides valuable guidance on monthly contributions needed to reach the goal.

Lump Sum at Retirement: Similar to the monthly contributions, this option calculates the lump sum required for retirement and offers insight into where to invest it.

3. Accessing Goals in Cashflow

Finding and using Goals is a breeze. It’s available on the results screen of any cashflow model within FinCalc, in the Charts & Data section. You’ll notice a tick or cross next to the Goals tab, indicating whether your clients can achieve their financial goals.

4. Goals within the Report

Goals isn’t just limited to on-screen analysis. It has also been integrated into the financial report, providing a clear and concise summary of the information available within the goals tab. You have the flexibility to show or remove this section in the report.

5. Additional Considerations

The tool comes with some helpful considerations. For example, if a specific retirement age isn’t available or if the client has already retired, the software makes assumptions for simulation purposes.

In summary, Goals in Cashflow is a game-changer for financial advisers and their clients. It simplifies the process of financial planning, offers valuable insights into achieving cashflow and retirement goals, and provides practical solutions to make those goals a reality. This innovative tool is set to streamline financial planning and help clients make informed decisions about their financial future.