As part of our continuing development, we are pleased to announce that our Retirement Modeller Tool is now available on FinCalc!

Since our Cashflow Modeller Launch in July 2020, we have been asked by many existing and potential customers to provide a way to answer the following retirement questions:

- Are my clients on track for their target retirement income?

- How much investment growth do they need to meet their target?

- Do they need to make additional pension contributions?

- What would happen if there was a market crash?

- What level of income is sustainable for my clients in retirement?

We have listened to these requests and produced a new FinCalc tool called Retirement Modeller.

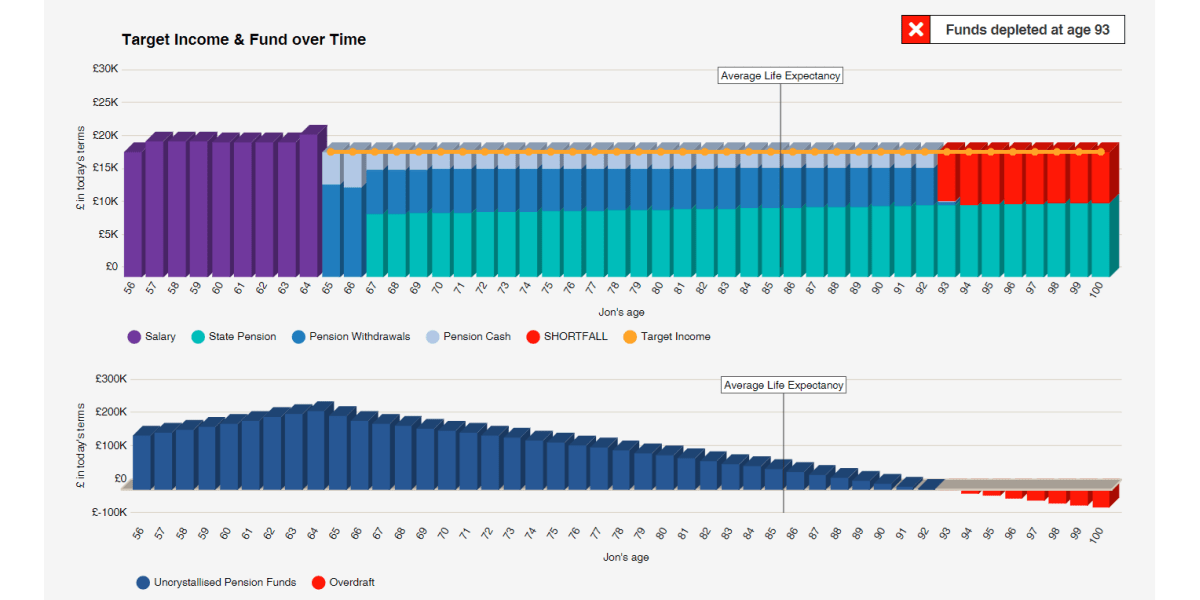

Retirement Modeller enables you to answer these questions very easily with straightforward inputs. By taking defined contribution funds, any pension contributions and any incomes, the modeller will quickly and efficiently provide results on whether the client’s target income objectives are realistic and achievable.

This is a very simple to use tool but behind the scenes we want to ensure that the output is comprehensive with Full UK Income Tax calculations, Lifetime Allowance, and the added functionality of maximising the Personal Allowance and deferring Higher Rate Tax for all clients in the modeller.

This FinCalc tool will take your Retirement Modelling to a new level with this goal seeking analysis to provide your clients with clear and concise results and comprehensive report that includes:

- Age that funds are depleted

- Annual safety margin/additional annual growth required

- Additional monthly/single contributions and the cost of delay

- Capacity to withstand a fall in value

- Sustainable income levels

This new tool is now available for all Cashflow Modeller users at NO EXTRA COST!

For further details on the Retirement Modeller, please contact us.